As tax time nears, a new report released by IRC, shows a continued decline in Americans’ participation in Individual Retirement Accounts.

The study, released in full today, shows an ever-widening gap between what average US citizens are saving for retirement and what they need to retire comfortably. As a result, Americans are working longer into their golden years and have less saved than at anytime in the past 30 years.

Once popular, IRAs have enjoyed tremendous adoption since their introduction in the 1970’s, but the last few years has seen that popularity decline into an almost apathy. Although 70% of all US household own some type of formal, tax-advantaged retirement plan, only 40% own an IRA.

IRA Contributions at Record Lows

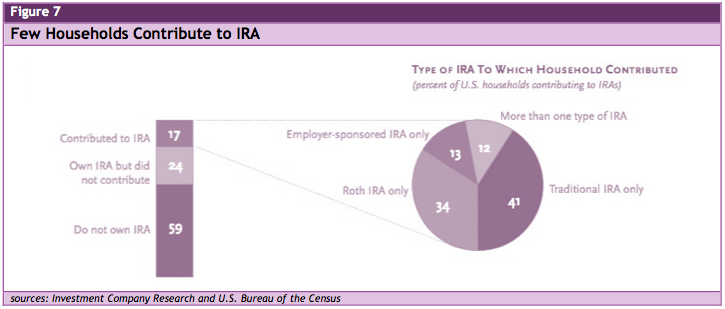

These numbers do not tell the whole story. Only 17% of US households made a contribution to their IRAs in 2010. This means that although a number of Americans own an IRA, but most don’t actually make yearly contributions. The study shows that most accounts site dormant and are underfunded, at best.

The decline in IRAs is attributed to several factors: the economic slowdown of the past few years, lingering repercussions from the housing crises, Americans’ declining savings rate, and also the availability of other retirement investments such as 401(k)s.

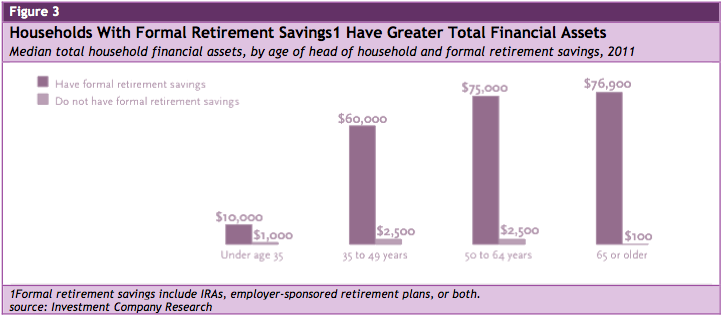

For those US citizens who do save through an IRA, the outlook is much rosier. The study reveals that owned an IRA for ten year or more and made a contribution last year, held assets of almost $150,000 – well above the national average. In general, households with retirement account have more savings overall than households without, a surprising amount more. IRA holding households are typically six times wealthier than households with no retirement account.

The Rich get Richer?

As expected, the new study shows that younger Americans are the least prepared for retirement. Those under 35, with no formal retirement plan, averaged less than $1000 in total financial assets. In the same age group, those with a retirement plan average around $10,000 in total assets.

The typical IRA owner is more likely to be older, married and employed full time than a non-IRA holder.

Finally, the study shows the continued popularity of Roth IRAs over traditional accounts. Because of IRS regulations, Roth accounts offer significant tax advantages over traditional IRAs, which have led to most folks leaving traditional IRAs behind.

For background, IRAs hit the US in 1974 when introduced by ERISA, or the Employee Retirement Income Security Act, as a means of encouraging Americans to increase savings. Although widely popular for the next 20 years, the US savings rate has continued to decline while debt and borrowing has increased.

The number of US citizens who counts an IRA in their investment portfolio has dipped to only 38%. This marks four years in a row of straight drops. The full report is available from IRC.