Putting aside savings is can be complex and requires dedication. One of the easiest ways to get your retirement savings on track is by opening up a Traditional IRA or Roth IRA. Investing in an IRA account is a great way of diversifying your retirement portfolio because of its excellent tax advantages and interest … [Read more...]

How much should I be planning to save for my retirement?

Eighty six percent of citizens have little confidence in their retirement plans or indeed, no plan at all. Many have no idea how much they should be saving to ensure some degree of financial stability in their retirement. Retirement planning can be difficult - a 'one size fits all' approach will not work. Everyone is … [Read more...]

How to Retire Rich With Poor Returns on your Money

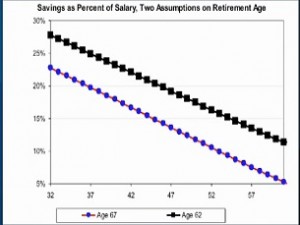

So do you want to know the impact your retirement age will have in terms of your retirement savings? If you plan to retire at 62 versus 67, you would have to invest almost 5% more to achieve that goal for 62. However what occurs if you plan to retire at 67 and because of medical reasons you have to retire at 62? A … [Read more...]

Study: Americans Contributing Record Low Amounts to IRAs

Study: Americans Contributing Record Low Amounts to IRAsA new study from Investment Company Research to examine the role of IRAs in Americans’ retirement preparedness. … [Read more...]