How are self-employed individuals supposed to save for their future retirement when they don’t have access to a 401(k), 403(b), 401(a), 457, or some other employer-sponsored supplemental retirement plan? Good question. The answer is to sign up for an SEP IRA – a Simplified Employee Pension Plan. What Is a SEP … [Read more...]

Why You Should Consider Relocating For Retirement

While some retirees live in comfort and peace, others struggle with high bills, a high cost of living and a home that does not fit their needs. This is why retirement planning should include a list of places of where you would like to live since many don’t realize how living expenses can quickly drain your retirement … [Read more...]

What are the Five Biggest Risks to my Retirement Planning?

Monetary inflation, the rising cost of health care, longer life span, and other potential circumstances are only some of the obstacles you may come to face when you retire. Without being properly prepared when plans go awry your dream of a comfortable life later on may be greatly compromised. Even if you had … [Read more...]

Retirement Planning: The Five Most Important Steps

Tax breaks, stock market behavior, the ever-fluctuating 401(k) & IRA rates; understanding these crucial sectors of your retirement plan can mean the difference between comfort and financial woes in your later years. Finding the best IRA rates is helpful to those who seek an early retirement age. Being prudent with … [Read more...]

Retirement Planning Calculator – Monthly Savings Tips

Eighty six percent of citizens have little confidence in their retirement plans or indeed, no plan at all. Many have no idea how much they should be saving to ensure some degree of financial stability in their retirement. Retirement planning can be difficult – a ‘one size fits all’ approach will not work. Everyone … [Read more...]

Retirement Plan Calculator – Save for Retirement

Retirement planning can appear complicated. There are many rules to follow for contribution limits for Individual Retirement Accounts (IRA’s), Roth IRA’s, and 401(k) plans. Understanding your retirement options and careful planning is necessary to reach your retirement goals. Could you retire on $47,357? That is the … [Read more...]

How to Retire Rich With Poor Returns on your Money

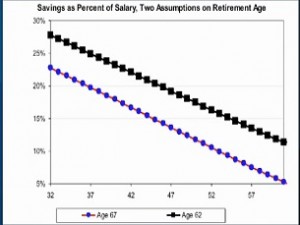

So do you want to know the impact your retirement age will have in terms of your retirement savings? If you plan to retire at 62 versus 67, you would have to invest almost 5% more to achieve that goal for 62. However what occurs if you plan to retire at 67 and because of medical reasons you have to retire at 62? A … [Read more...]

I don’t want to pay taxes on all that money!!!

Are you trying to figure out ways to not pay taxes on all that money you plan on putting into retirement, watch this video to understand how a Roth IRA can do this. Ever been curious why it's called a Roth IRA,... we're pretty sure you don't care, but we are certain you want to know about its power to get you the … [Read more...]

Hey Boss! Why don’t you pay for my future!

Why is over $30 billion dollars invested in 401k plans? For starters many 401k participants are earning contributions from their employers. Have your employer pay for your future and learn about what a 401K can do for you in this video. Spend a few minutes if you want to learn more about how a 401k works and if … [Read more...]

5 IRA Mistakes that Cost You Money

In July of 2013, the Worker's Retirement Institute reported that the average value of IRAs (Individual Retirement Accounts) in the United States fell to less than $28,000 the lowest number in a decade. This means Americans, some unemployed, must work even harder to pay for their retirement. The sad part is that most … [Read more...]