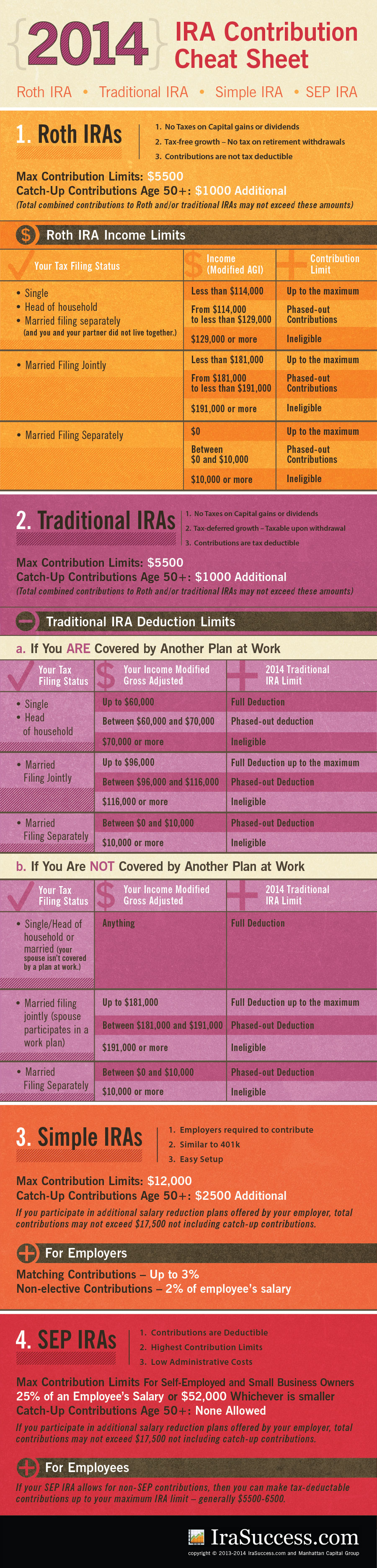

In 2014, the IRS changed many of the IRA limits allowed for every type of account. Keep track of all the tax, income and contribution limits with this handy chart below. For complete IRA information see:

- Traditional IRA Rules – Covers all 2014 Traditional IRA Regulations

- 2014 Roth IRA Limits – Roth IRA rules have changed this year.

- SEP Contribution Limits – Up to date information on 2014 SEP IRA Contributions

- Simple IRA Rules – Complete Guide to Simple IRAs

The good news is that limits are rising across the board for all types of individual retirement accounts. This includes both Roth and Traditional IRAs, as well as Simple and SEP plans. Don’t forget your contribution deadlines.

2014 IRA Contribution Cheat Sheet for Roth, SEP, Simple and Traditional Retirement Accounts

Embed This Image On Your Site (copy code below):

2014 Plain Text Version

Jump to: Roth IRA – Traditional IRA – Simple IRA – SEP IRA

I. Roth IRAs

1. No Taxes on Capital gains or dividends 2. Tax-free growth – No tax on retirement withdrawals 3. Contributions are not tax deductable

Roth IRA Income Limits

Use this 2014 IRA contribution limits chart to find your maximum contribution based on income (AGI).

| Your Tax Filing Status | Income (Modified AGI) |

Contribution Limit |

|---|---|---|

|

Single, head of household, or married filing separately and you and your partner did not live together. |

Less than $114,000 |

Up to the maximum. |

|

From $114,000 to less than $129,000 |

Phased-out Contributions |

|

|

$129,000 or more |

Ineligible |

|

|

Married filing jointly |

Less than $181,000 |

Up to the maximum. |

|

From $181,000 to less than $191,000 |

Phased-out Contributions |

|

|

$191,000 or more |

Ineligible |

|

|

Married filing separately and you lived with your partner at least some of the year |

$0 |

Up to the maximum. |

|

Between $0 and $10,000 |

Phased-out Contributions |

|

|

Above $10,000 |

Ineligible |

For more information see Roth IRA Limits.

II. Traditional IRAs

1. No Taxes on Capital gains or dividends 2. Tax-deferred growth – Gains taxable upon withdrawal 3. Contributions are tax deductible

Traditional IRA Deduction Limits

Use the following 2014 IRA deduction chart to determine your maximum deduction based on income.

| You are Covered by Another Plan at Work | You Are Not Covered by Another Plan at Work | |||

|---|---|---|---|---|

| Tax Filing Status | Your Income Modified Gross Adjusted | 2014 Traditional IRA Limit | Your Income Modified Gross Adjusted | 2014 Traditional IRA Limit |

|

Single or head of household |

$60,000 or less |

Full Deduction |

Anything |

Full Deduction! |

|

More than $60,000 and less than $70,000 |

Phased-out deduction |

|||

|

$70,000 or more |

Ineligible |

|||

|

Married filing jointly |

$96,000 or less |

Full Deduction up to the maximum. |

$181,000 or less |

Full Deduction up to the maximum. |

|

More than $96,000 to less than $116,000 |

Phased-out Deduction |

More than $181,000 to less than $191,000 |

Phased-out Deduction |

|

|

$116,000 or more |

Ineligible |

$191,000 or more |

Ineligible |

|

|

Married filing separately |

Less than $10,000 |

Phased-out Deduction |

Between $0 and $10,000 |

Phased-out Deduction |

|

$10,000 or more |

Ineligible |

Above $10,000 |

Ineligible |

|

For more information visit Traditional IRA Regulations.

III. Simple IRAs

1. Employers required to contribute 2. Similar to 401k 3. Easy Setup

For Employers

Matching Conributions – Up to 3% Non-elective Contributions – 2% of employee’s salary For more information visit the Simple IRA Rules.

IV. SEP IRAs

1. Contributions are Deductible 2. Highest Contribution Limits 3. Low Administrative Costs

- 25% of an Employee’s Salary or

- $52,000 Whichever is smaller

Catch-Up Contributions: None Allowed If you participate in additional salary reduction plans offered by your employer, total contributions may not exceed $17,000 not including catch-up contributions.

For Employees

If your SEP IRA allows for non-SEP contributions, then you can make tax-deductible contributions up to your maximum IRA limit generally $5000-6000. For more information visit SEP IRA Rules.

Embed This Image On Your Site (copy code below):